How do you calculate an injured workers average weekly wage in Minnesota?

In order to calculate workers’ compensation benefits, an injured workers’ average weekly needs to be determined. Average weekly wage is the beginning point in calculating work’ comp wage loss benefits including temporary total, temporary partial and permanent total disability. This is not always an easy taks. In most cases, the insurer will utilize an average weekly wage by adding the injured workers’ paychecks for the 26 weeks prior to the date of injury and dividing it by the number of weeks works. While this is a simple and easy way in calculating an average weekly wage it is not necessarily the correct way or the only way to calculate the wage.

Arriving at Fair Approximation

In MN work comp, the law has required that that object of average weekly wage determination is to arrive at a fair approximation of the employee’s probable future earning power which has been destroyed by the injury. In order to arrive at a fair approximation the injured worker includes certain benefits including:

• Tips and gratuities

• Overtime if regular or frequent

• Sick leave

• Vacation and holiday pay

• Bonuses if tied directly to the employee’s performance

• Value of Room/Board

What is not included:

• Pension/Profit sharing

• Employer contributions to insurance

• Mileage/travel expenses

• Overtime if not regular or frequent

Regular v. Irregular Earning

An injured workers’ average weekly wage will be calculated differently depending on whether their wages are Regular or Irregular. An employee’s wage is irregular if there is a variance in the number of hours worked each day or in the number of days worked each week or if the hourly wage earned by the employee varied.

Calculating Regular Wages

First add the injured workers’ paychecks for the 26 weeks prior to the date of injury and divide it by the number of weeks works up to 26 weeks. There may be different variations depending the facts of the case.

Calculating Irregular Wages

First you must determined the daily wage.

Daily Wage:

- Divide Total Earnings over 26 weeks by the Days Actually Worked =X

Next, calculate the Average Days:

Average Days:

- Divide Days Actually Worked by Weeks Actually Worked = Y

Lastly, calculate the Average Weekly Wage.

AWW:

- Multiply Average Days per Week (Y)by the Daily Wage (X)= Average Weekly Wage

Calculating the correct average weekly depends on a number of factors. It is always a good idea to consult a with an experienced workers’ compensation lawyer.

Second Job

Earnings from a second job or concurrent employment at the time injury are includable in the injured workers’ average weekly wage calculation.

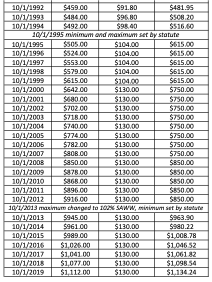

Maximum Compensation and Minimum Rates

The Department of Labor and Industry keeps an up to date list of the Maximum and Minimum compensation rates for wage loss. It can be found on DOLI’s website. https://www.dli.mn.gov/sites/default/files/pdf/annladj.pdf

Cost of Living Adjustments

For injuries occurring on or after October 1, 1995, a cost of living adjustment does not occur until the fourth anniversary of the date of injury.